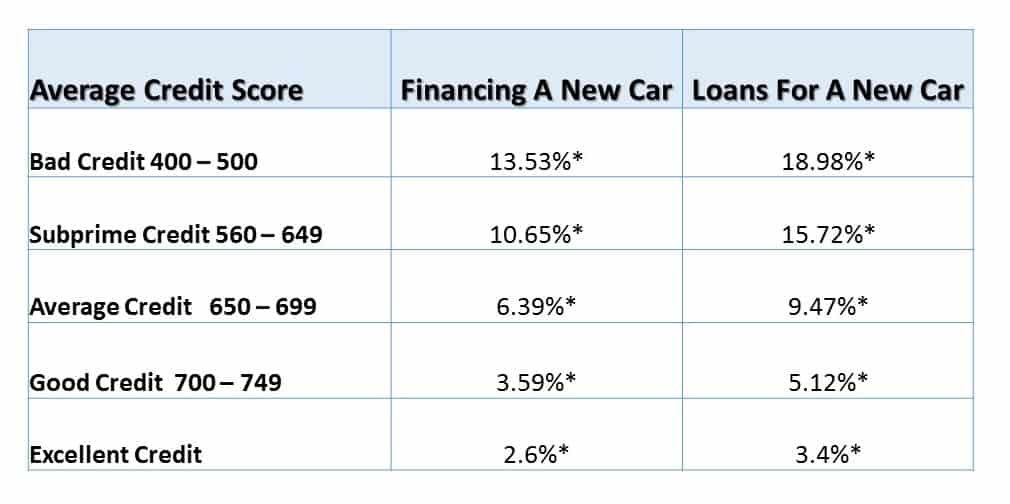

What is a good credit score to buy a car or qualify for a car loan? The answer to this question isn't likely to be one answer because lenders look at every loan differently.

Each lender will offer loans, which they believe to be fair for your credit history and credit score. In this guide, we'll look especially at car loan lenders and auto loans to answer the question, “what sort of credit score do I need to buy a car?" Because you will find there's a large difference in auto loans and credit scores versus other kinds of credit lenders.

We have helped thousands of applicants with low credit car loans and monthly payments they can afford, which not only got them a fantastic car but rebuild their credit score fast.

Here are some helpful hints to follow when looking for low credit score car loans to purchase a car.

Get the Car You've Always Wanted Regardless of Your Credit Get Pre-Qualified

Get the Car You've Always Wanted Regardless of Your Credit Get Pre-Qualified

How To Pay Off Car Loan Faster?

Read More

How To Pay Off Car Loan Faster?

Read More

All about Buy Here Pay Here Car Lots in a Nutshell

Read More

All about Buy Here Pay Here Car Lots in a Nutshell

Read More

What Exactly Are Tote-The-Note Car Lots?

Read More

What Exactly Are Tote-The-Note Car Lots?

Read More

Car Loans for Less than Perfect Credit

Read More

Car Loans for Less than Perfect Credit

Read More

Tips To Follow When Applying For Low Credit Car Loans

Read More

Tips To Follow When Applying For Low Credit Car Loans

Read More

Budget Your Next Vehicle Purchase for Newer Tech Features

Read More

Budget Your Next Vehicle Purchase for Newer Tech Features

Read More